Unlock the IUL Strategy to Escape the 401k Tax Trap and Retire with Up to $1.5M Tax-Free

Build tax-free retirement wealth with guaranteed growth and zero market risk—start today with a FREE Strategy Session

2.4M

Average Tax-Free Wealth Created

500+

Famililes Helped

0%

Market Loss Protection

If you're a high-income professional or business owner earning $100K+, you've worked hard to build wealth. But here's the harsh reality:

Your 401(k) and IRA are ticking tax time bombs. Every dollar you contribute today will be taxed at ordinary income rates when you retire—potentially 30%, 40%, or even higher as tax rates climb.

Market volatility keeps you up at night. One bad year can wipe out years of gains. And when you're forced to take required minimum distributions, you have no control over timing or tax consequences.

Traditional retirement accounts leave your family exposed. If something happens to you, your loved ones inherit a tax burden along with your wealth.

There's a Better Way...

Max-Funded IUL (Indexed Universal Life) gives you tax-free retirement income, guaranteed growth protection, permanent life insurance coverage, and complete control—all in one powerful strategy used by the wealthy for decades.

I'm Neil Brown, and after 15 years helping executives and entrepreneurs optimize their wealth, I've seen firsthand how Max-Funded IUL transforms financial futures. Let me show you how

Introducing: Max-Funded IUL

The financial tool Wall Street doesn't want you to know about.

Tax-Free Growth: Your money grows without Uncle Sam taking a cut

Market Protection: Capture market gains without the losses (0% floor protection)

Liquid Access: Borrow against your cash value tax-free anytime

Legacy Benefits: Leave a tax-free nest egg to your family

Other Investments: Use it for buying real estate, kids college, and much more

Real Numbers, Real Results

"I wish I had known about IUL 20 years ago. I've built over $800,000 in tax-free cash value while still getting life insurance protection. Last year, I borrowed $150,000 tax-free to expand my business. This strategy changed everything for me."

- Marcus R., Manufacturing Business Owner

Why Trust Us With Your Financial Future? Meet Neal Brown, your Licensed Professional

I'm Neal Brown, founder of Achievers Financial. After (a lifetime of owning businesses), I saw the same pattern: high earners were being steered into conventional plans that benefited banks and Wall Street—not families.

I started this firm with one mission: show successful professionals and business owners the wealth-building strategies typically reserved for the ultra-wealthy. Max-Funded IUL is one of those strategies.

Licensed IUL and Annuities specialist who helps families protect what matters most

Have helped 1,000s of clients grow wealth and protect their families through personalized IUL solutions

Passionate about making complex financial strategies easy to understand and actionable for you to make the best decisons

Six Reasons Max-Funded IUL Beats Traditional Retirement Plans

What Exactly Is Max-Funded IUL?

Think of Max-Funded IUL as a turbocharged savings vehicle that combines the best features of multiple financial products:

How it works: You overfund a specially designed permanent life insurance policy, minimizing the death benefit cost and maximizing cash value accumulation. Your cash value grows tax-deferred based on a market index (like the S&P 500), but with a safety net that protects you from losses.

In retirement, you access your money through tax-free policy loans—no income taxes, no penalties, complete control.

This isn't whole life insurance. It's not term insurance. It's an Indexed Universal Life policy structured specifically for maximum wealth accumulation—the same strategy wealthy families have used for generations.

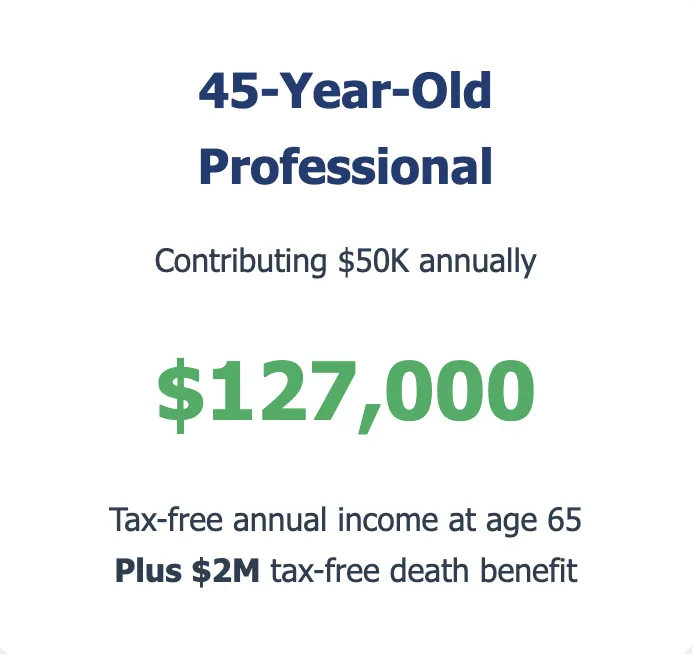

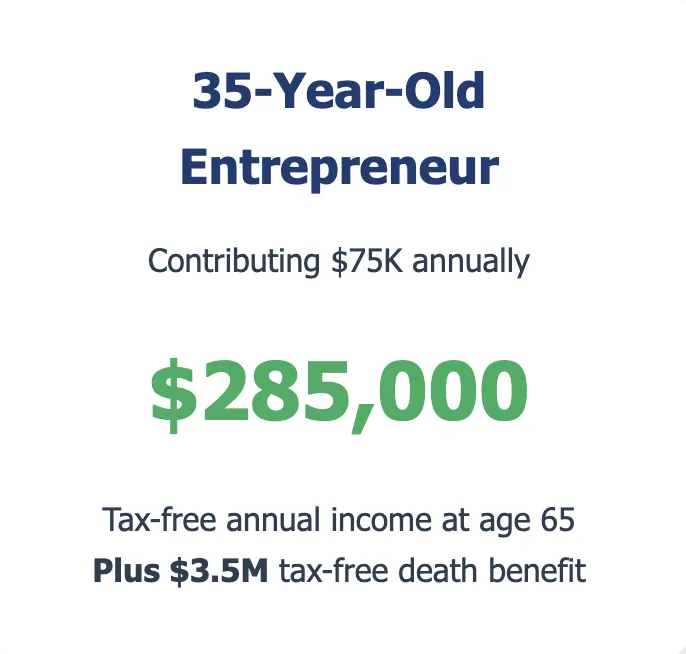

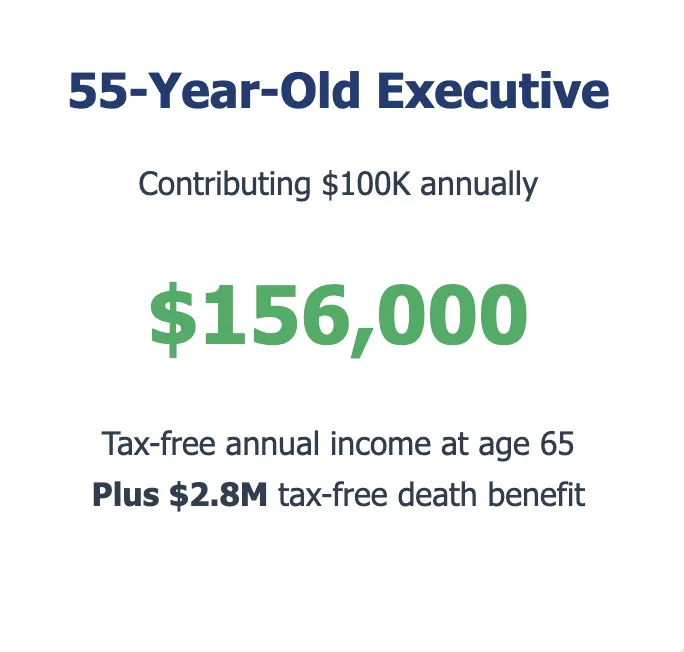

The Math That Changes Everything

Let's say you're 45 and planning to retire at 65. You contribute $50,000 annually to either a 401(k) or a Max-Funded IUL.

Scenario 1: Traditional 401(k)

After 20 years at 7% average return: $2.2M account value

Annual retirement income: $88,000

After 30% taxes: $61,600 net income

Death benefit to family: $2.2M (fully taxable)

Required distributions at age 73: Forced taxation

Scenario 2: Max-Funded IUL

After 20 years at 7% average return: $2.1M cash value

Annual retirement income: $105,000 (tax-free loans)

After 0% taxes: $105,000 net income

Death benefit to family: $3.5M (100% tax-free)

No required distributions: Total control

That's $43,400 more in your pocket every year—forever. Over a 25-year retirement, that's over $1 million more to spend, plus $1.3M more to your heirs.

And this assumes equal returns. But with Max-Funded IUL, you never lose money in market downturns, so your actual returns are often higher over time due to loss avoidance.

Plus, you maintain complete flexibility: Need to access money for a business opportunity at age 55? No penalties. Want to help your kids buy a home? Tax-free loan. Unexpected medical expenses? Your money is there, accessible anytime.

Your Simple 4-Step Path to Tax-Free Wealth

The entire process takes 3 days - 3 weeks from start to finish.

Imagine Your Life With Tax-Free Retirement Income

Retire on Your Terms: Travel the world. Start that passion project. Spend time with grandkids. With tax-free income that never runs out and no forced distributions, you control your retirement lifestyle completely.

Sleep Easy Every Night: Market crashes don't touch you. Tax law changes don't affect you. Your family is protected with millions in tax-free death benefit. True financial peace of mind is priceless.

Build a Lasting Legacy: Leave your children and grandchildren a tax-free inheritance that changes their lives. Fund education. Help with home purchases. Create generational wealth that outlives you.

*Watch this short video to see how it works:

Real Stories From Real People

"After 8 years with my max funded IUL, I have over $400k in cash value that's completely tax-free. My advisor showed me exactly how to structure it for maximum efficiency."

- Michael R., Business Owner

"As a high-income professional, I was getting killed on taxes. Max funding my IUL has saved me thousands annually while building wealth I can actually access."

- Sarah T., Surgeon

"As a high-income professional, I was getting killed on taxes. Max funding my IUL has saved me thousands annually while building wealth I can actually access."

- David L., Engineer

Why You Need to Act Now

The longer you wait, the more you lose to taxes and missed growth

Every year you delay costs you:

✗ Thousands in unnecessary taxes on your current retirement accounts

✗ Compound growth you'll never get back

✗ Higher insurance costs as you age

✗ More exposure to market crashes

We only accept 15 new clients per month to ensure personalized service.

Discover Exactly How Much You Could Save (Value: $1,500)

*This 15-minute discovery phone call will give you complete clarity on whether Max-Funded IUL is right for you. No pressure. No sales pitch. Just honest analysis.

Our Triple Guarantee

1. Transparency Guarantee: We'll show you every fee, every assumption, and every number in your policy. No surprises, no fine print, no hidden costs.

2. Fiduciary Guarantee: We're legally bound to put your interests first. If Max-Funded IUL isn't right for you, we'll tell you—and show you what is.

3. Performance Guarantee: Your policy includes contractual guarantees: zero loss floors, minimum interest rates, and locked-in death benefit. Everything in writing.

Plus, you get a 30-day free look period. If you're not 100% satisfied after policy delivery, return it for a full refund. Zero risk to you.

Common Questions About IULs

How is this different from whole life insurance?

Max-Funded IUL uses Indexed Universal Life insurance, not whole life. The key differences: IUL offers higher growth potential tied to market indexes, more flexibility in premium payments, and typically lower costs. Whole life has fixed returns and fixed premiums. IUL is specifically designed for wealth accumulation.

What happens if the market crashes?

Your cash value is protected by a contractual floor (typically 0-1%). If the S&P 500 drops 40%, you lose nothing. Your account stays flat or earns the minimum guaranteed rate. This is why IUL often outperforms 401(k)s over time—loss avoidance is powerful.

How much do I need to contribute?

Most of our clients contribute $15K-$150K annually, though it's completely customizable. The key is maximizing cash value while minimizing insurance costs. During your strategy session, we'll design the optimal funding level for your situation and goals.

Can I really access the money tax-free?

Yes. You access your money through policy loans, which are not considered taxable income under current tax law. As long as the policy remains in force, loans are tax-free. This is the same strategy used by banks and wealthy families for decades.

What if I already have a 401(k)?

Perfect! Max-Funded IUL complements your 401(k) beautifully. Many clients continue 401(k) contributions (especially with employer match) and add IUL for tax diversification. You're creating multiple income streams with different tax treatments—the smartest retirement strategy.

How long until I can access my money?

Technically, you can access cash value as soon as it accumulates. However, policies are designed for long-term wealth building. Most clients wait 5-7 years before taking loans to maximize growth. Unlike 401(k)s, there's no age 59½ restriction and no penalties—ever.

What happens if I can't make a payment?

Max-Funded IUL offers incredible flexibility. You can reduce, skip, or pause payments if needed. Your cash value can even cover premiums automatically. This flexibility makes it perfect for business owners and high earners with variable income.

Is this legal? Why don't more people know about this?

Completely legal—it's been used by wealthy families for over 100 years. Most people don't know about it because: (1) traditional financial advisors can't offer it, (2) it requires specialized knowledge to structure properly, and (3) it doesn't generate ongoing management fees for advisors. That's why it stays relatively unknown.

Here's Everything You Get

Tax-free retirement income for life—no matter how tax laws change

Market-linked growth with zero downside risk—guaranteed floor protection

Millions in tax-free death benefit—permanent family protection

Complete access and flexibility—your money, your terms, no penalties

No contribution limits—build wealth as fast as you want

No required distributions—stay in control forever

The question isn't whether you can afford Max-Funded IUL.

The question is: Can you afford NOT to have it?

Every day you wait is another day of unnecessary taxes, missed growth, and market exposure. Take the first step toward tax-free wealth today.

Call (855) 964-4140

Email: [email protected]